DELIVERY OVERVIEW

I have repeatedly worked on the UBS Neo platform on several occasions. UBS launched it as an entirely new approach to investment banking client engagement. The concept was to deliver the very best of UBS; its people, content, research, trading ideas, pricing and execution capabilities. It was developed to provide the firm’s clients with a seamless cross-asset experience, and a fully integrated cross-functional experience, all in one place. Originally developed in FLEX, the Adobe Flash Player standard, I was part of the team that oversaw it's transition in to HTML5"

Whilst working on UBS NEO the platform won the following industry awards:

- 2019. Profit & Loss Digital FX Award

- 2020 Profit & Loss Digital FX Awards

- 2021 FX Markets Best Bank Awards

- 2022 FX Markets e-FX Awards

- 2023 Euromoney FX Awards

- 2024 Euromoney FX Awards

- 2024 FX Markets Asia Awards

PLEASE NOTE THE FOLLOWING IMAGES ARE REDACTED MOCKUPS FOR OBVIOUS REASONS

CASE STUDY: NEO - AMC

Actively Managed Certificates (AMC's) are groups or "stock baskets" of trades set up by investment managers. The AMC rebalancing tool was created from scratch. Initially a back office, hand drafted exercise, using xl spread sheets and Formulas the turnaround time was anything from days to weeks with each request.

The AMC app was designed to help recalculate re-balances and new purchases on the fly. Each basket contained around 20-30 stocks and acted as a quicker way to respond to strategy changes of the Investment Managers (IM's). Each re-balance is checked by the Trading Desk and feedback generated via the AMC app. Total time involved was 2 weeks of user research, 3 weeks of design and prototyping and 4 weeks of build, making it one of the fastest apps to be built from scratch on the entire NEO platform.

DISCOVER & DEFINE: REQUIREMENTS GATHERING

The following gallery is the research obtained from stakeholder interviews, current tech integration requirements, service maps and speculative design as sketches done in workshops. Once the key problem was defined we moved immediately in to initial prototypes.

DESIGN & DEPLOY: WIREFRAMING & PROTOTYPING

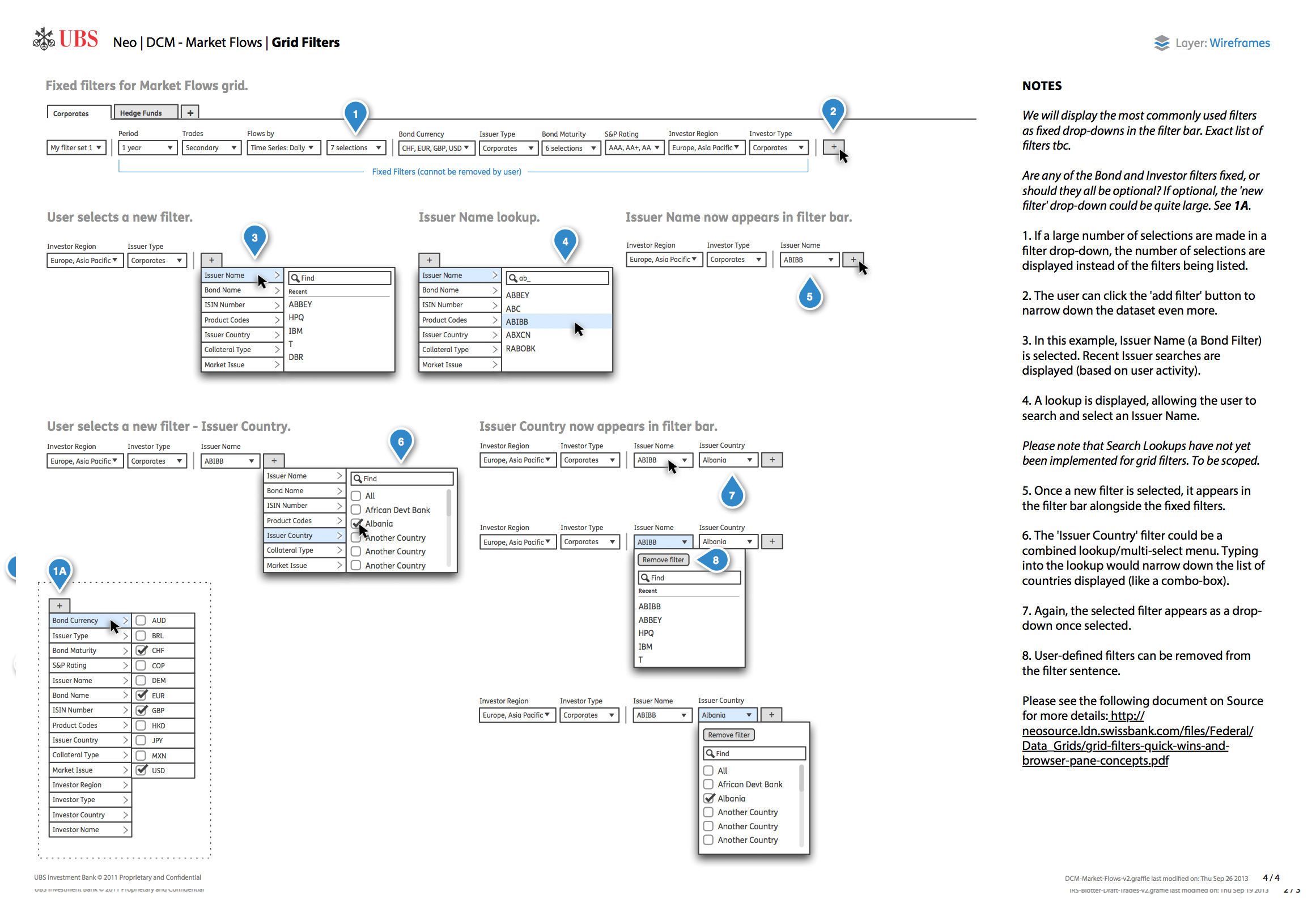

Initial wireframes were built from the framework perspective first. The requirements were desktop only and so we wireframed straight in to the app shell with minimal functionality for the first round of testing. Once the initial display items had been decided upon the Re-balancing Tools were added, the ALGO methods were then plugged in to the flows.

The flexibility and user-friendly nature of Neo has won the platform widespread support. UBS's Neo is the best platform in the market for AMCs. It offers an easy and quick way to execute re-balancings.

Jonathan Roberts, Head of Structured Finance, UBS

Other products on the NEO platform included enhancements for:

- Babel Capture – Sales and Trader work-flow management

- CDS – Credit default swaps trading

- Fixed Income – Credit bonds, pricing options

- IRS - Multiple IRS portfolio management

- DCM - Debt capital market - market flows

- iQuote - quoting interface for equity derivative structured products

- RFQ - Integration of Dodd-Frank legal requirements

- UI Component Set - Enhancements to pricing grid, charts, colour scheme & forms