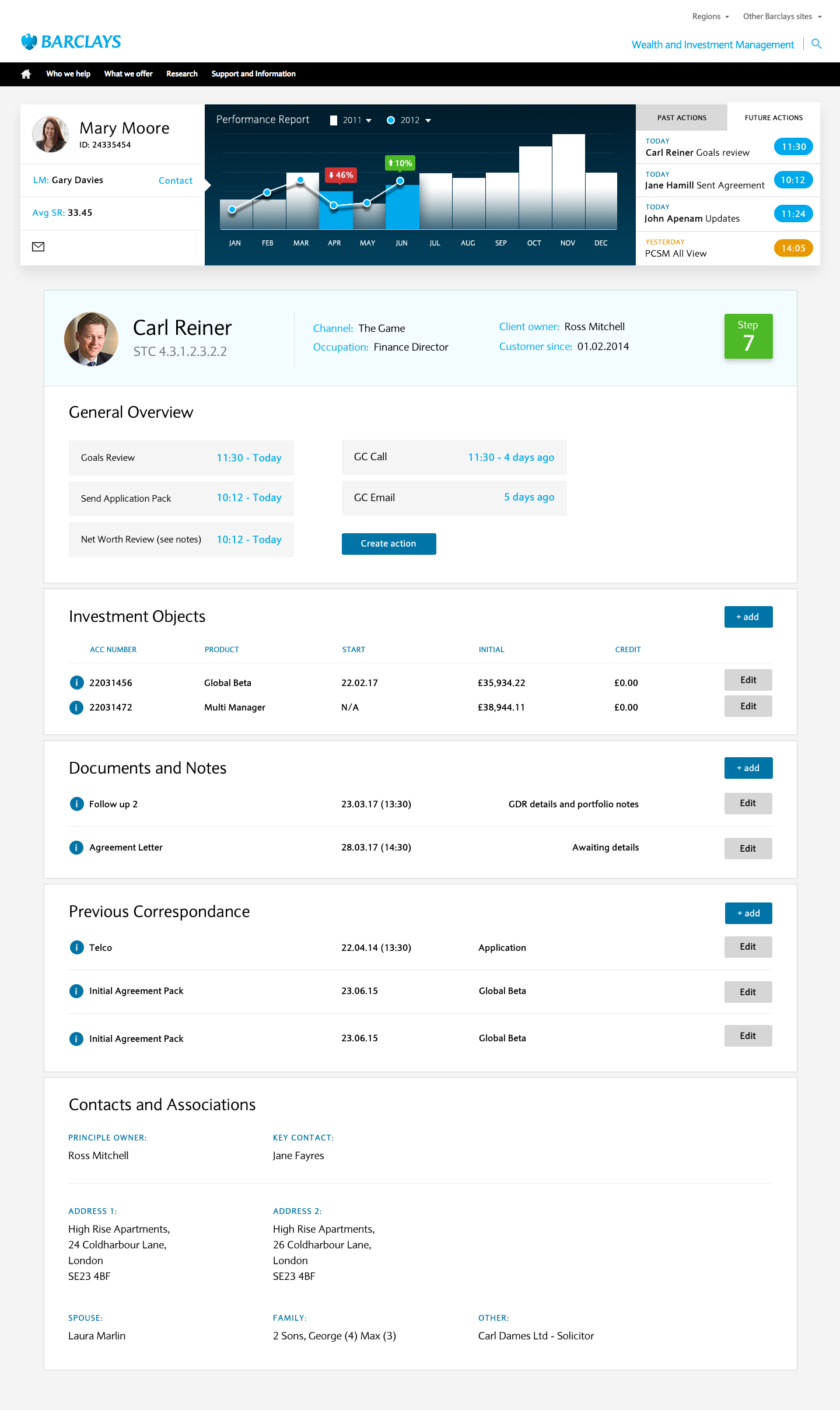

Since 2008 I have worked with various Barclays brands including BARX, Barclays Wealth, Barclays Mobile and PingIt and helped design and integrate Machine Learning to aid shortcutting lengthy on-boarding procedures for back office processes for the Relationship Managers.

PORTFOLIO REBALANCING WITH AUTO ML INTEGRATION

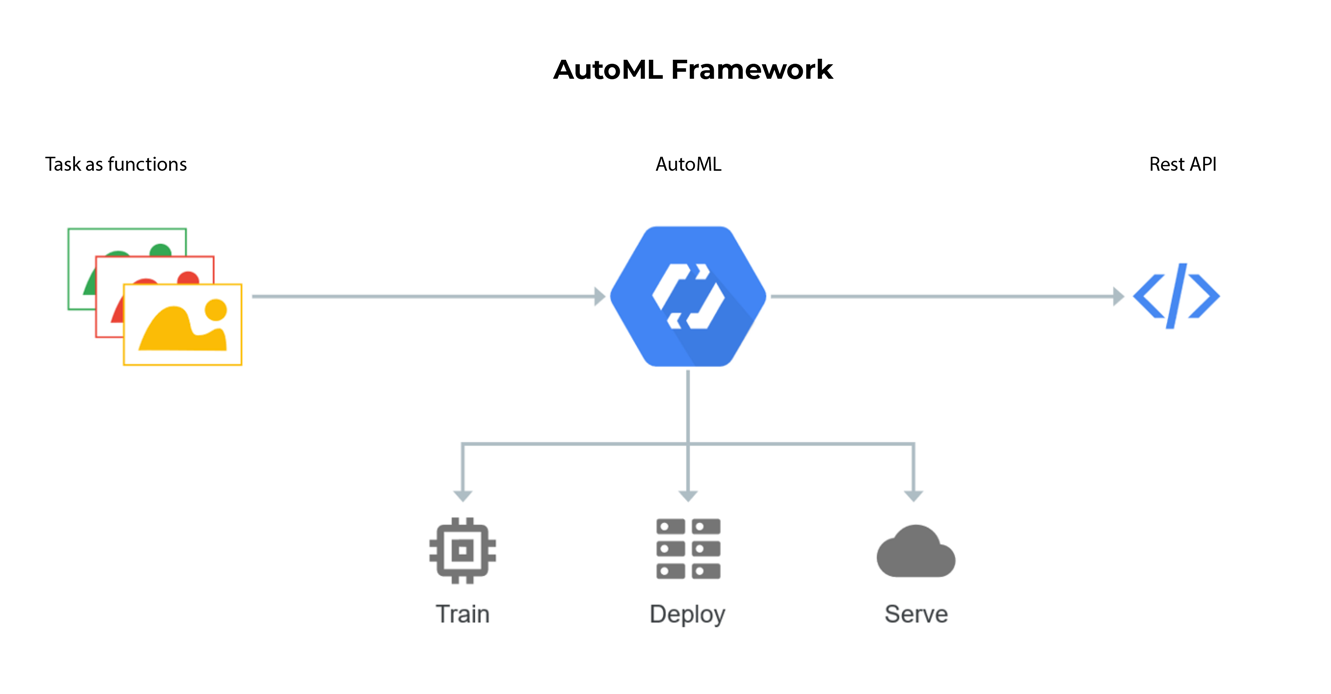

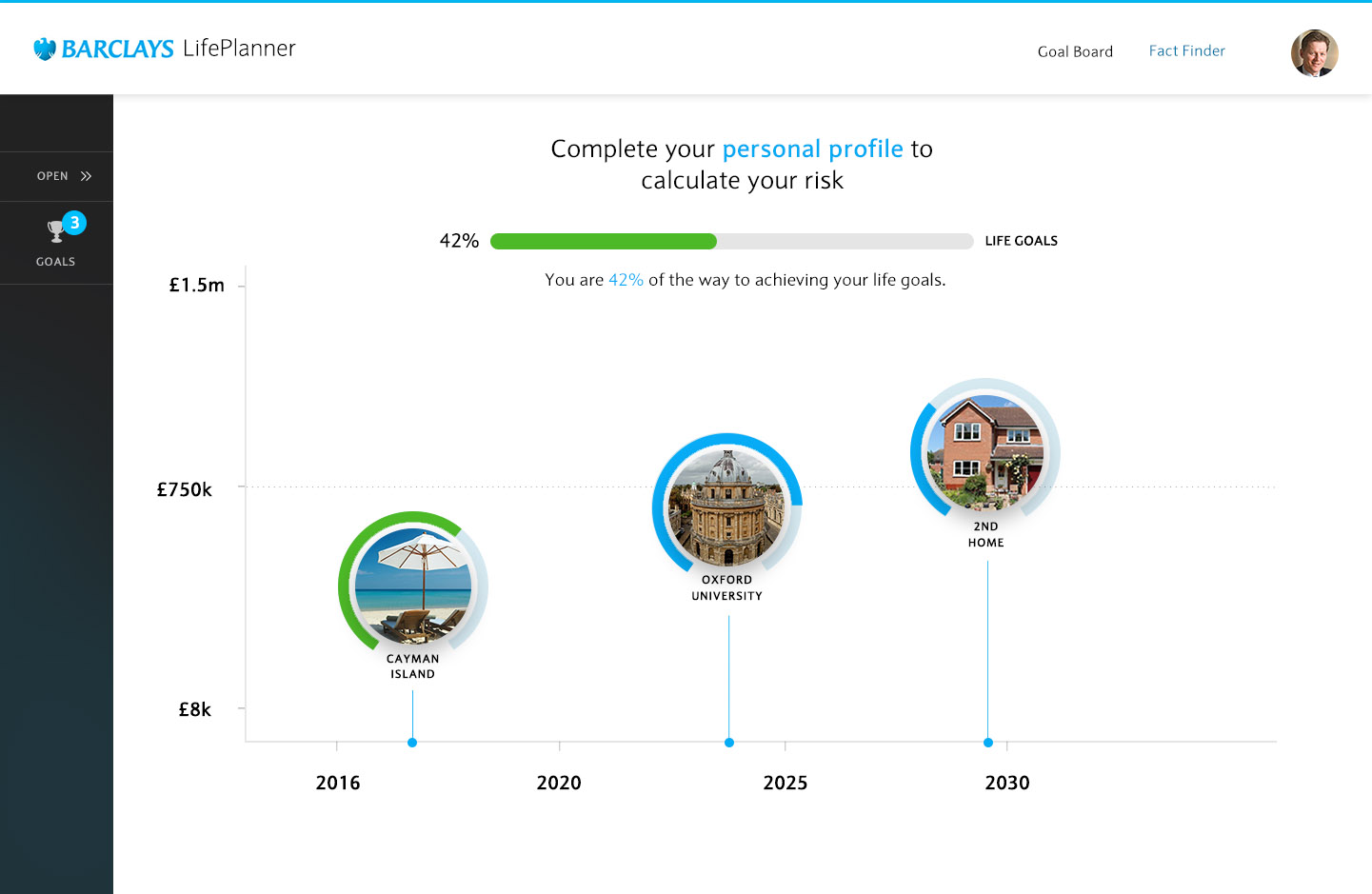

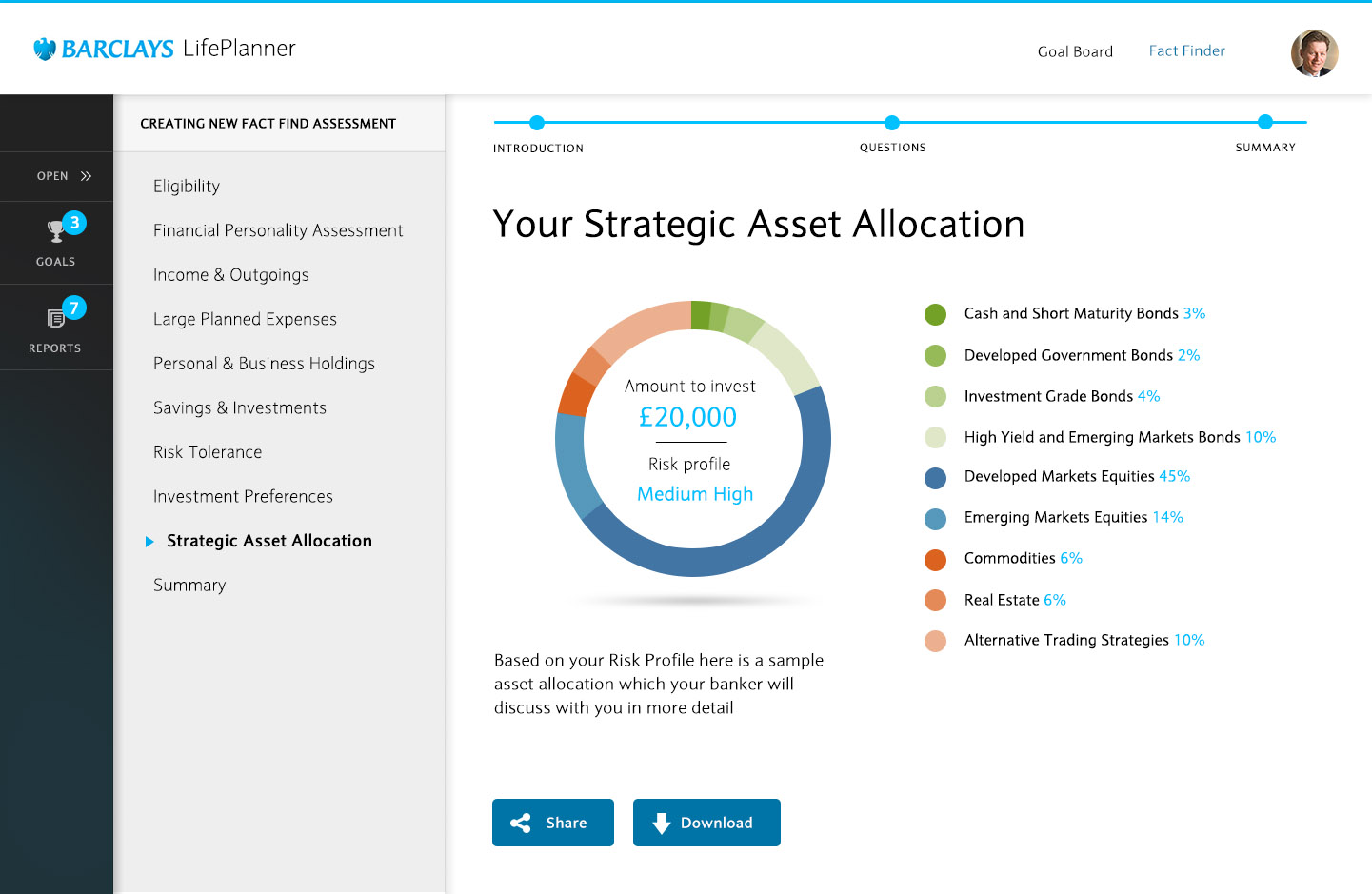

The following overview shows the process of integrating autoML in to non-automated time-consuming tasks using a machine learning model of development. We had to look at both the customer journey side as well as all back office processes.

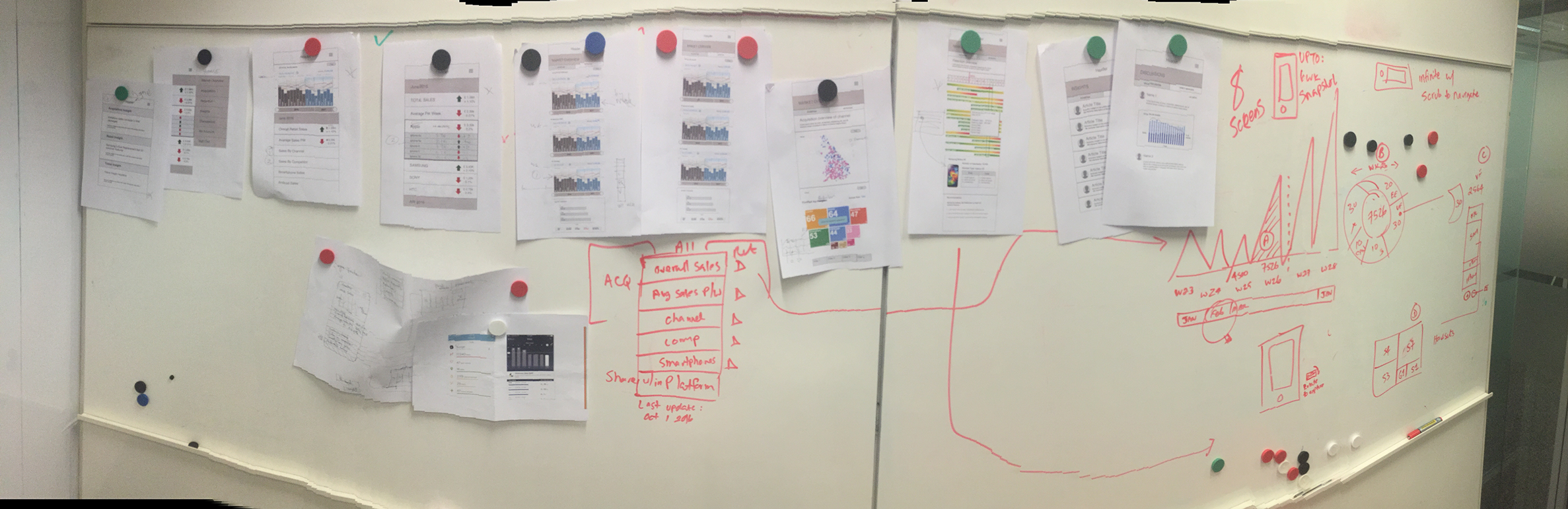

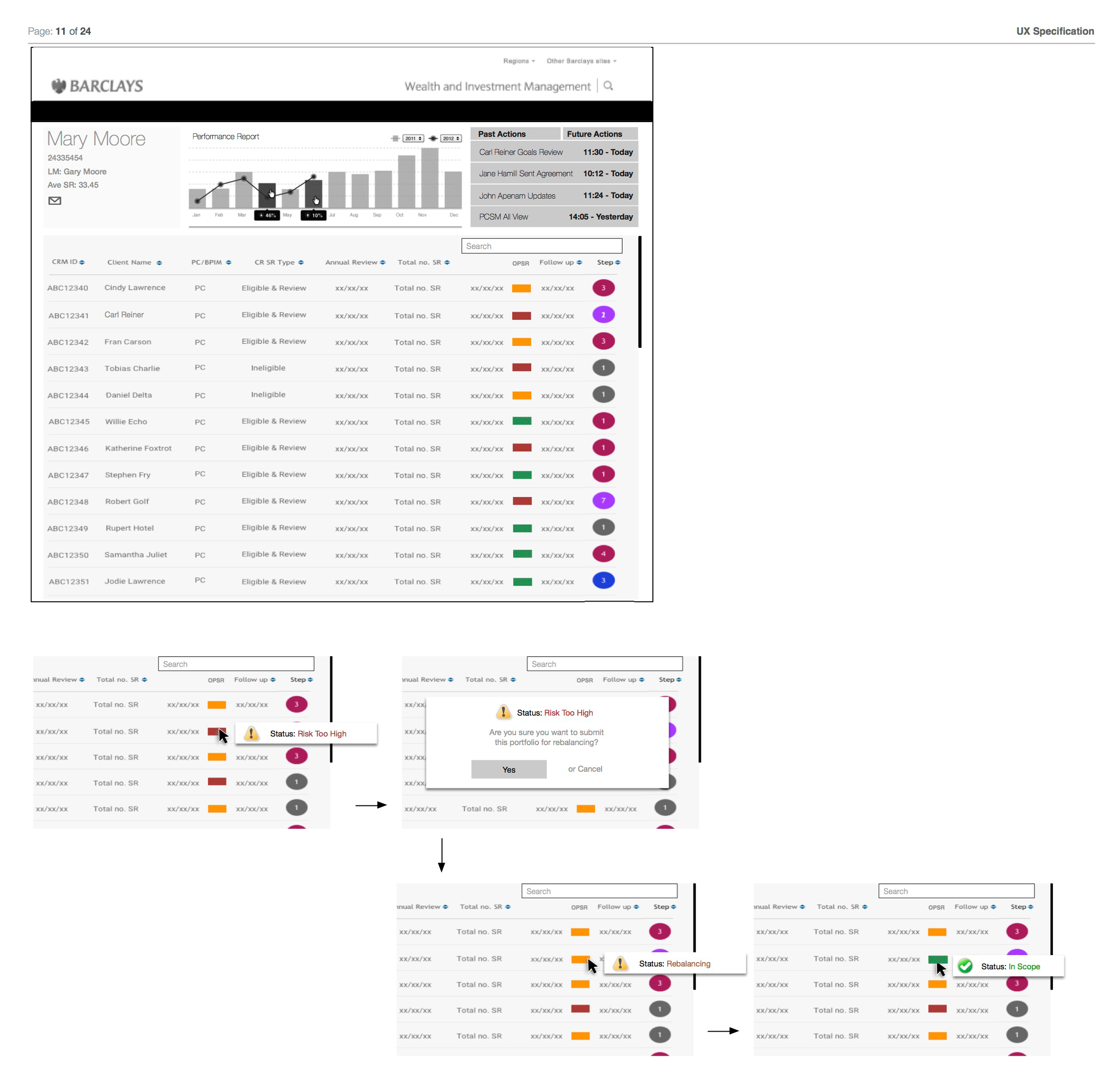

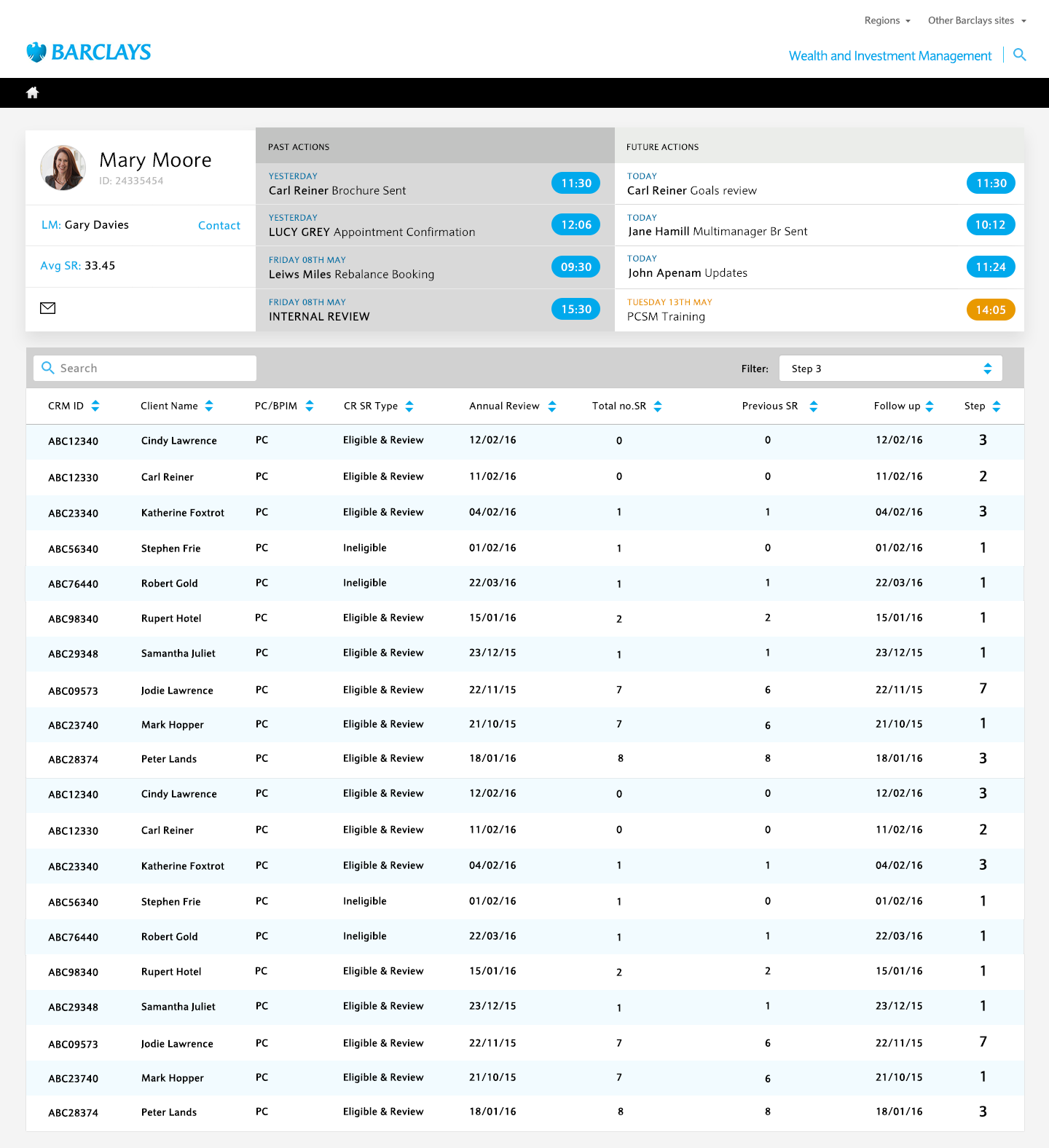

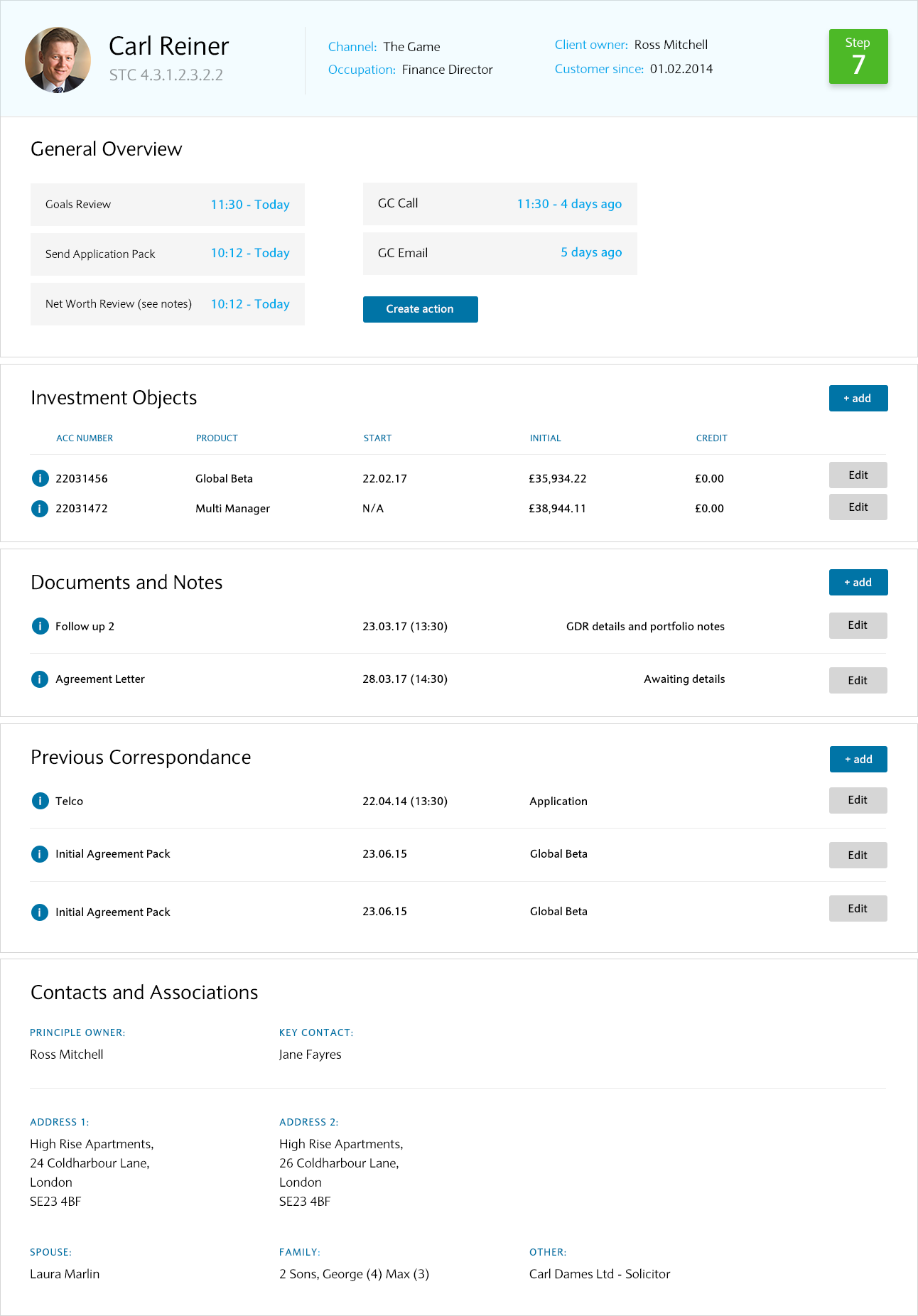

First we needed to understand the full legal process of the HNWI portfolio re-balancing work-flow and it's current compliance laws. It's an extremely lengthy process involving a lot of back and forth between client and Portfolio Relationship Manager. We created a war room in which we spent time in stakeholder workshops understanding the different processes and how they are silo-ed in to task lists that take place on the BARCLAYS Wealth & Investment Management platform. The platform itself was also undergoing a re-branding.

My responsibilities on this project were:

- Running and managing all stakeholder interviews

- Reporting research results to the team

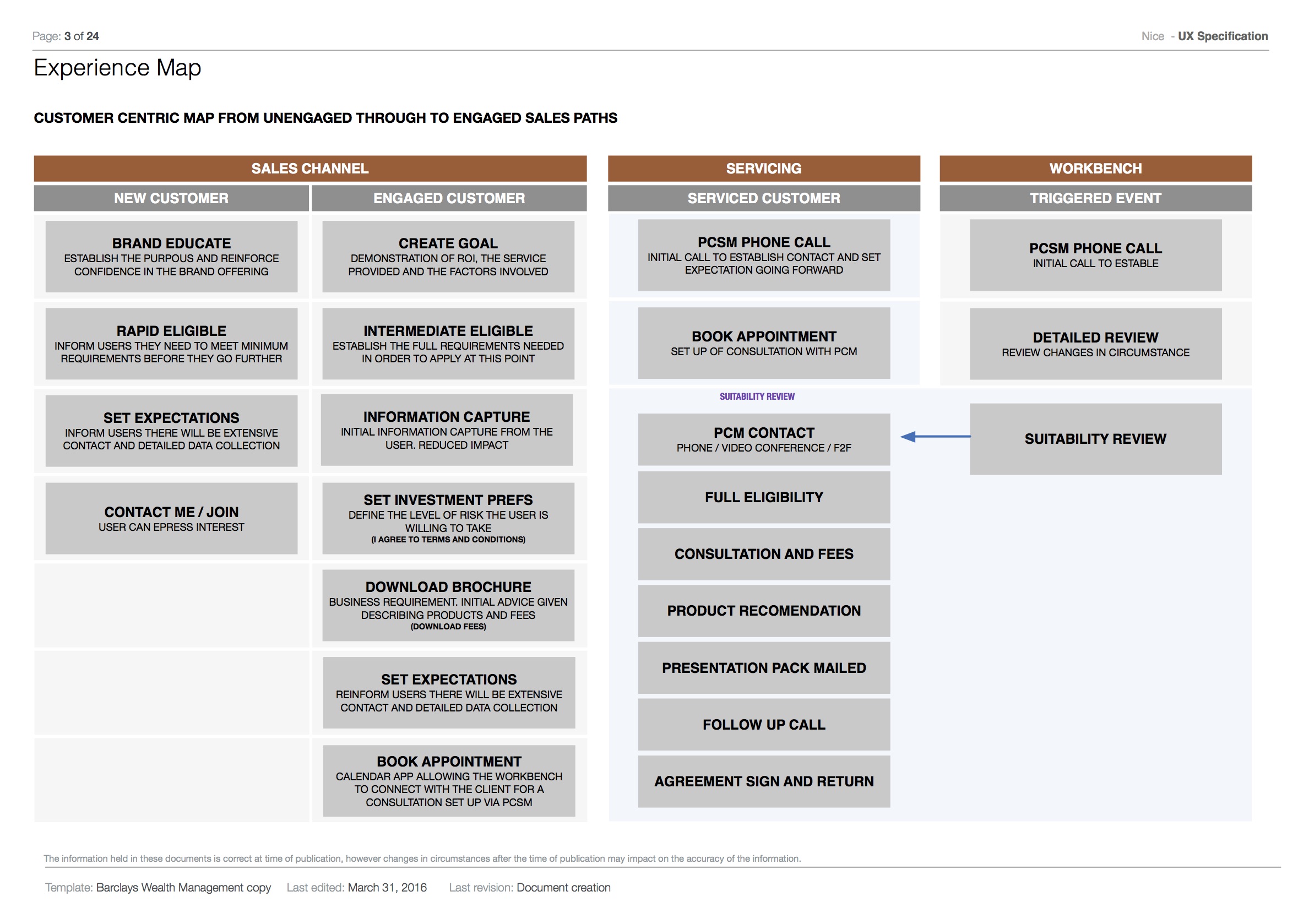

- Mapping the sales paths from the Portfolio Managers perspective

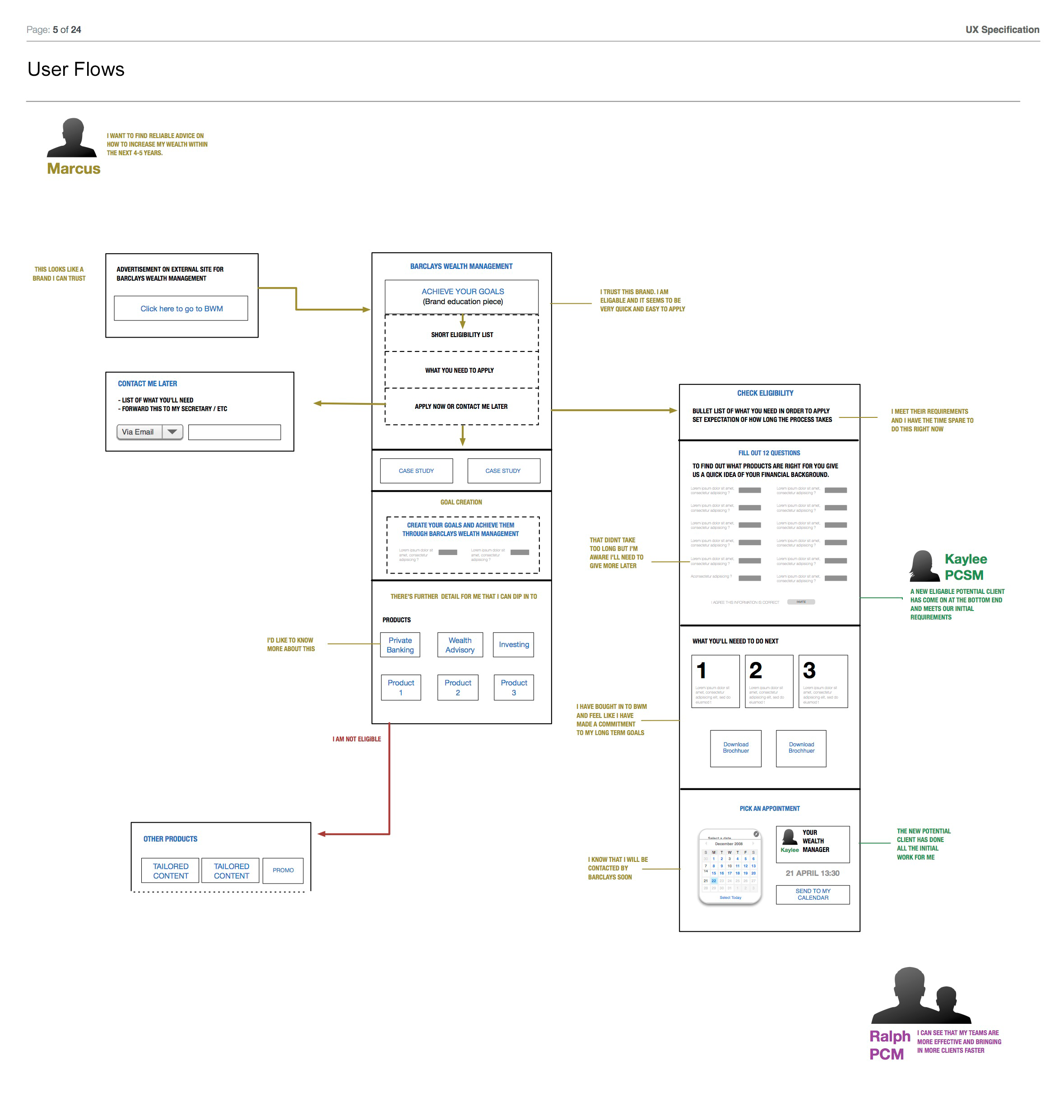

- Creating wirfeflows, swimlanes and user flows

- Presenting UX and UI outputs to development

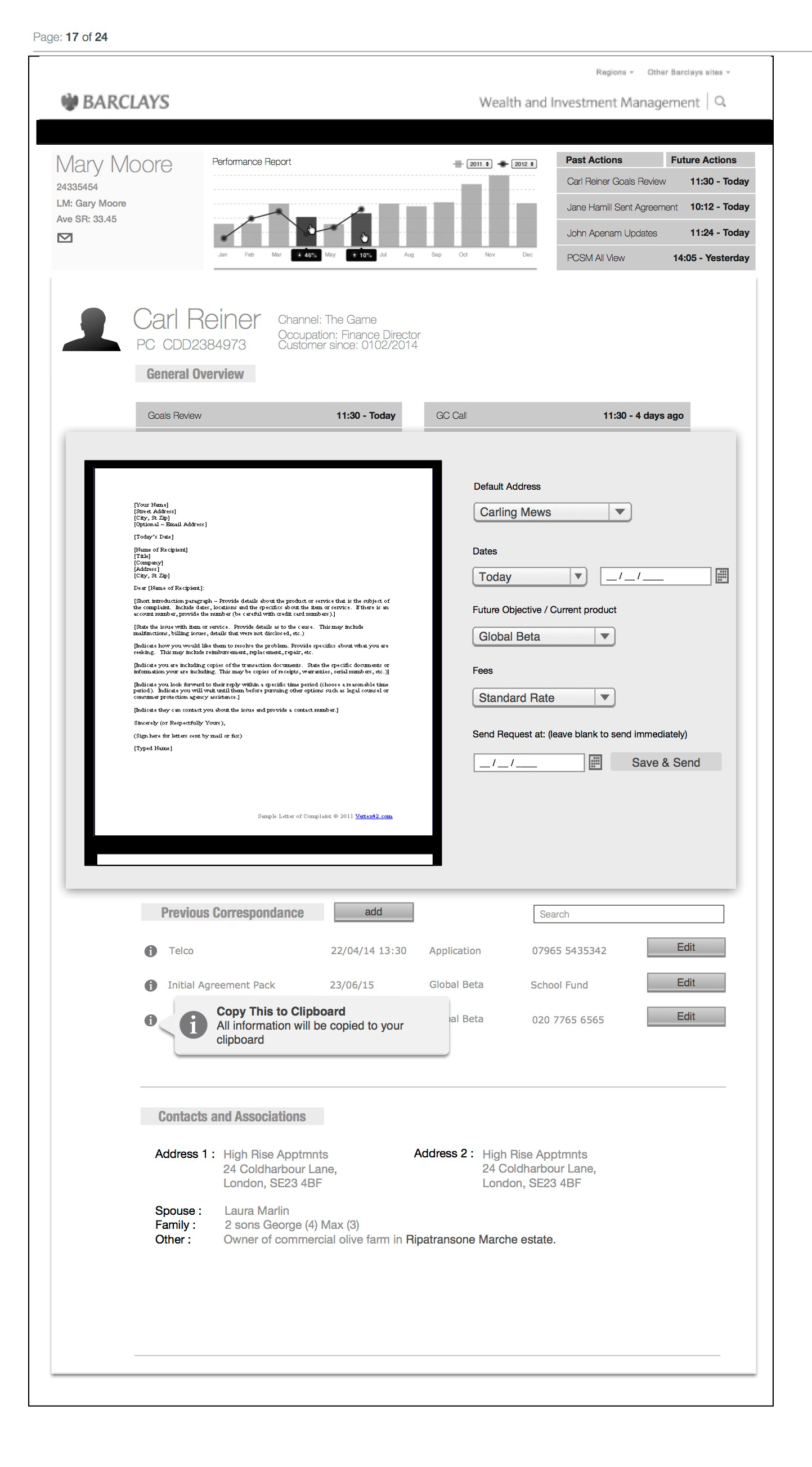

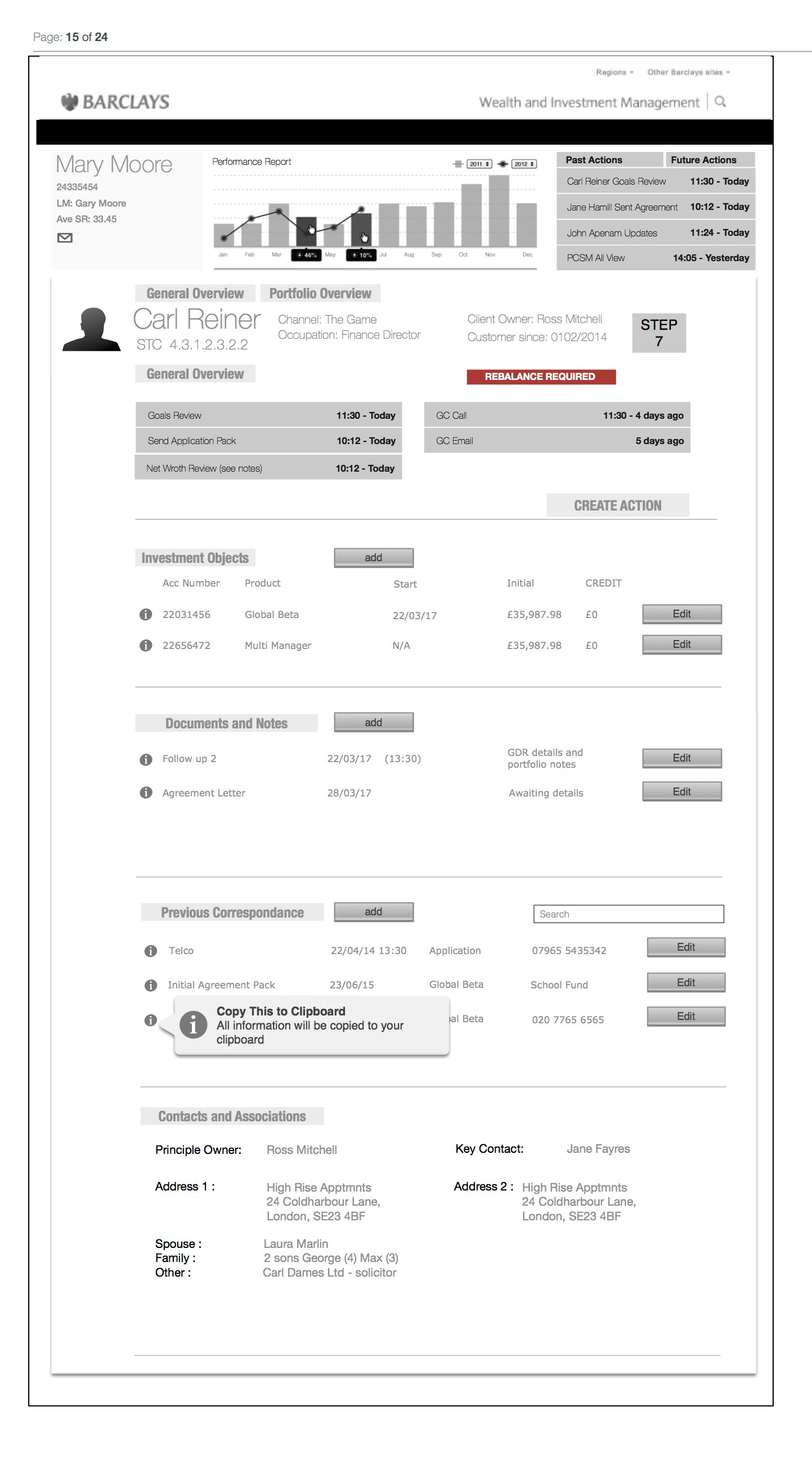

- Creating wireframes for UI Design

- Creating clickable prototypes for dev

UX STRATEGY & RESEARCH

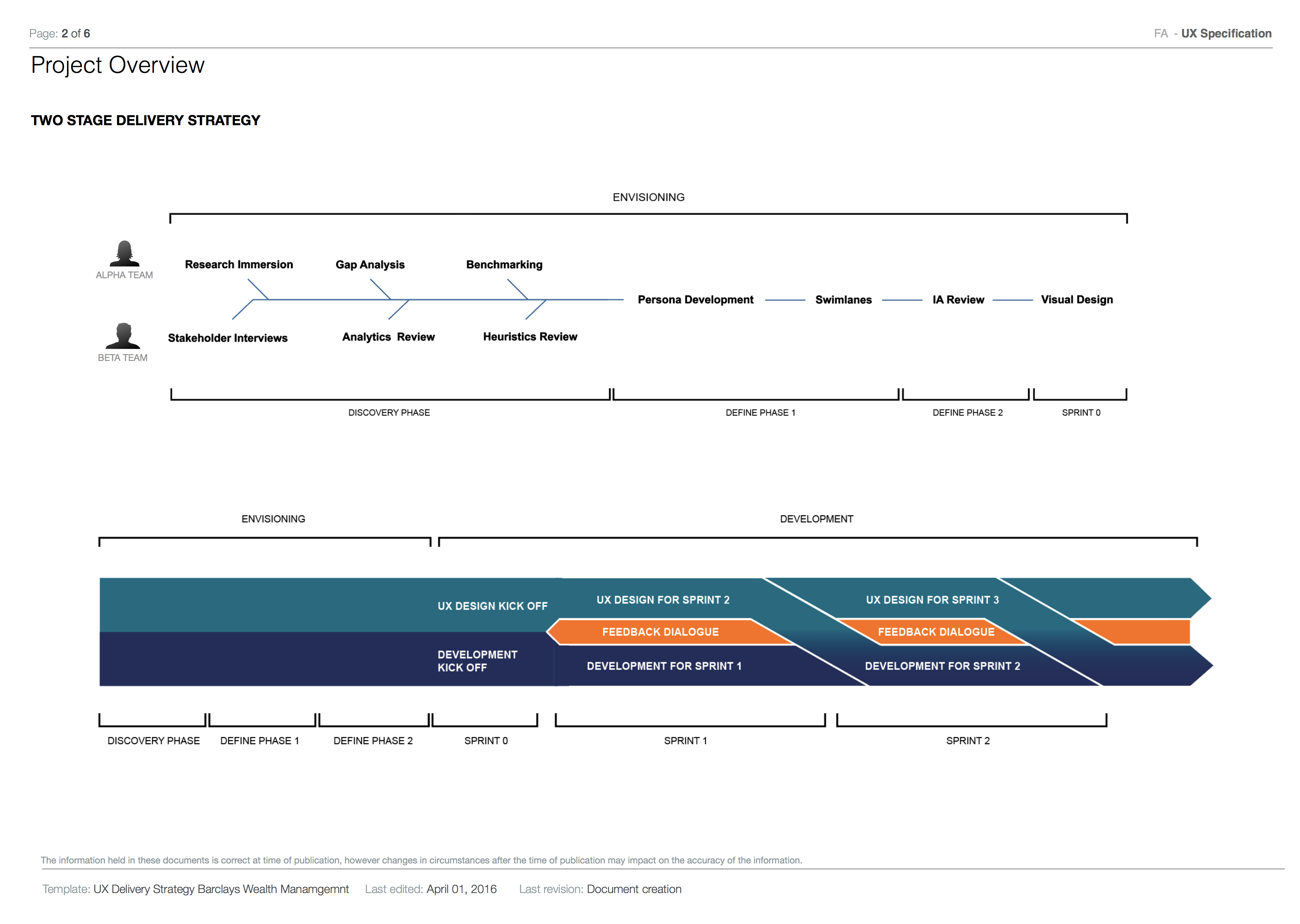

In order to ensure the quickest deployment of the project I split the overall strategy in to 2 teams. We used a double diamond approach with both teams driving the discovery phase to help feed the external ML devs who knew very little about the current system. Customer journey maps and Feature prioritization maps were presented alongside Storyboards. Pre-existing personas and user research data sets already existing and were integrated in to the final report.

Each set of tasks were split in to user flows and presented back to the client to run cognitive walk-thoroughs

ML + PROTOTYPING

From each of the flows a series of components were mapped to user task lists in Epic journey sets that sat on the current system to allow devs to plug in the right ML models

RESULTS

The final outputs were a series of automated tasks than enabled wealth managers to increase their productivity across the platform. This included:

- Reduction in proposal drafting by 35%

- Wealth Manager client coverage increase by up to 130%

- Average task completion reduced on average by 18%

- Overall turnaround time reduced from 14 to 11 days turnaround

- A more consistent brand look and feel across the platform